Bond Fund of the Month: Carmignac Sécurité

Source: Carmignac, Morningstar. © 2020 Morningstar, Inc - All rights reserved. Morningstar Category: EUR Diversified Bond – Short Term. Data in Euro as of October 31st 2020. Strategy AuM is calculated by adding Carmignac Sécurité (ISIN: FR0010149120) and Carmignac Portfolio Sécurité (LU1299306321) assets under management. Performances of Carmignac Sécurité A EUR Acc (ISIN: FR0010149120) are net of fees (excluding possible entrance fees charged by the distributor). *Past performance is not necessarily indicative of future performance.

Developments since the start of the year

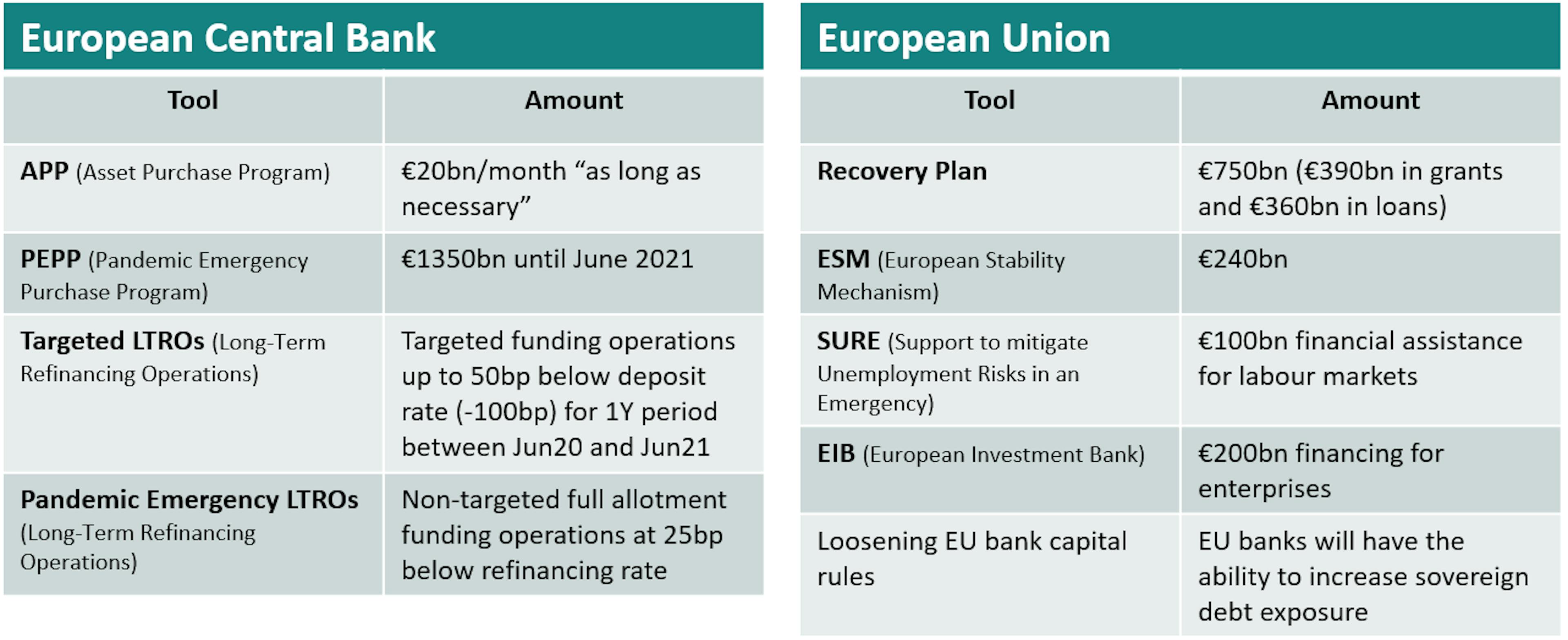

2020 has seen an unprecedented effort by central banks and governments to try to limit the negative economic fallout from the Covid-19 pandemic. Even more than the amounts pumped into the economy, what has made that response so extraordinary has been the simultaneous action by monetary and fiscal authorities. For example, the European Central Bank (ECB) has worked in concert with the European Union to compellingly convey their determination to keep interest rates low in order to ensure easy financial conditions with the help of tools to support the economy.

The assurance that the ECB would unfailingly buy financial assets, combined with the European Union’s pledge to cover part of member states’ financing needs as of 2021, has been enough to keep eurozone bond yields reasonably steady.

The other big winner in this policy mix has been corporate credit. Despite the unprecedented economic slump, companies have managed from early April onwards to secure the funding they need via primary issues. Our Fund has invested extensively in them to access the relatively high yields on offer. Once the worst was over, the low overall level of so-called risk-free rates, combined with central-bank support through asset purchases, made it possible for corporate credit to book solid performance. Credit spreads have thus narrowed considerably since May.

How we’ve gone about lifting the Fund’s performance

![[Insights] 2020 11_FF_Fund_CS (Pro)2 EN](https://carmignac.imgix.net/uploads/article/0001/13/CS%20image%202.PNG.png?auto=format%2Ccompress&fit=fill&w=3840)

We’ve scaled back our holdings in the eurozone periphery. The lockdowns and ensuing government spending responses are bound to drive up fiscal deficits, thus invalidating our previous reasons for maintaining high exposure to issuers in those countries. Bonds from the eurozone periphery were badly battered by a flight to core by fixed-income investors in March.

![[Insights]2020 11_FF_Fund_CS (Pro)3 EN](https://carmignac.imgix.net/uploads/article/0001/13/CS%20image%203.PNG.png?auto=format%2Ccompress&fit=fill&w=3840)

We’ve stepped up our corporate credit allocation to take advantage of the primary market and the sizeable spreads on offer. In addition, the new situation has opened up opportunities in sectors that were particularly hard-hit by the public health crisis. In response, we have made targeted investments in hotels, restaurants and leisure industry providers, airlines and carmakers, where the securities of companies suffering unwarranted sell-offs in relation to their fundamentals could be snapped up at bargain prices. Many companies with commanding positions in their industries, sound business models, healthy balance sheets and guaranteed access to liquidity due to their ability to pledge their assets as collateral (even if the public health crisis drags on for 12 to 18 months).

By end-July, we had raised our exposure to this kind of debt to a high point – 67% of our total portfolio (not including investments in CLOs) – accounting for almost two thirds of the Fund’s total modified duration. From then on, we gradually reduced duration, and more markedly so in late August, in order to take profits and limit volatility risk. We have mainly sold the longest maturities in our portfolio on negative-yielding bonds, as well as on issues that didn’t enjoy direct European Central Bank support.

We’ve actively managed the peripheral and core debt in our portfolio. The transition from national to increasingly Europe-wide crisis-fighting measures, along with the ECB’s announcement of highly favorable borrowing terms for banks, convinced us to engineer a substantial return to short-dated eurozone peripheral sovereign bonds (mainly Italian and Portuguese). Our holdings in core countries (not only Germany, but also the United States and Australia) have gone in the opposite direction. One by-product of the ongoing monetary policy easing is that market volatility can be expected to stay low – a plus point for carry strategies. We have accordingly moved to significant exposure to Italian sovereign debt, as it is now supported by a combination of ECB policy, the EU recovery package and lower medium-term political risk.

The upshot is that Carmignac Sécurité’s year-to-date return is +0.51%, vs +0.01% for its reference indicator* and -0.44% for its Morningstar category as of 31 October 2020.

The way forward

At end-October, corporate bonds accounted for 56% of our total assets (not including CLOs) and government bonds 24%. In corporate credit, we are holding onto our roster of issuers heavily affected by the Covid-19 slump and our selection of European structured credit. We also favour European bank debt, an asset class amply buoyed by central-bank largesse. The abundant, cheap liquidity now available to banks comes in addition to the long-range support they enjoy, thereby contributing to their efforts over the past several years to clean up their balance sheets.

The Fund’s overall modified duration is around 290 basis points.

We will therefore be hewing to a cautious stance in the final quarter of the year so as to mitigate the impact of a possible rise in volatility. 2020 will clearly be remembered as a year of momentous changes – and surprises for financial markets. The US elections, Brexit and new European lockdowns in response to the virus all have the potential to generate market volatility. Following the recent vaccine discovery which has led to volatility spikes in rate and spread markets beginning of November, investors now should focus on Central bankers reactions. By reducing portfolio risk while holding onto several strong convictions, we at Carmignac Sécurité should have the agility required in such an environment.

![[Insights] 2020 11_FF_Fund_CS (Pro)4 EN](https://carmignac.imgix.net/uploads/article/0001/13/CS%20graph%204.PNG.png?auto=format%2Ccompress&fit=fill&w=3840)

Carmignac Sécurité AW EUR Ydis

- Recommended minimum investment horizon

- 2 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Related articles

Carmignac Portfolio Global Bond: Letter from the Fund Manager

Carmignac P. Flexible Bond: Letter from the Fund Managers

Carmignac P. Credit: Letter from the Fund Managers

This is an advertising document. This document is intended for professional clients. This document may not be reproduced, in whole or in part, without prior authorisation from the management company. This document does not constitute a subscription offer, nor does it constitute investment advice. Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. Access to the Fund may be subject to restrictions with regard to certain persons or countries. The Fund is not registered in North America, in South America, in Asia nor is it registered in Japan. The Funds are registered in Singapore as restricted foreign scheme (for professional clients only).The Fund has not been registered under the US Securities Act of 1933. The Fund may not be offered or sold, directly or indirectly, for the benefit or on behalf of a "U.S. person", according to the definition of the US Regulation S and/or FATCA. The Fund presents a risk of loss of capital. The risks and fees are described in the KIID (Key Investor Information Document). The Fund's prospectus, KIIDs and annual reports are available at www.carmignac.com, or upon request to the Management Company. The KIID must be made available to the subscriber prior to subscription.

- In Switzerland, the Fund’s respective prospectuses, KIIDs and annual reports are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland) S.A., Route de Signy 35, CH-1260 Nyon.The paying agent is CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon.

- In the United Kingdom, the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This material was prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg and is being distributed in the UK by Carmignac Gestion Luxembourg UK Branch (Registered in England and Wales with number FC031103, CSSF agreement of 10/06/2013).