Carmignac Portfolio Long-Short European Equities: Letter from the Fund Manager

![[Management Team] [Author] Heininger Malte](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Heiniger-Malte.png?auto=format%2Ccompress&fit=fill&w=3840)

Dear Investors,

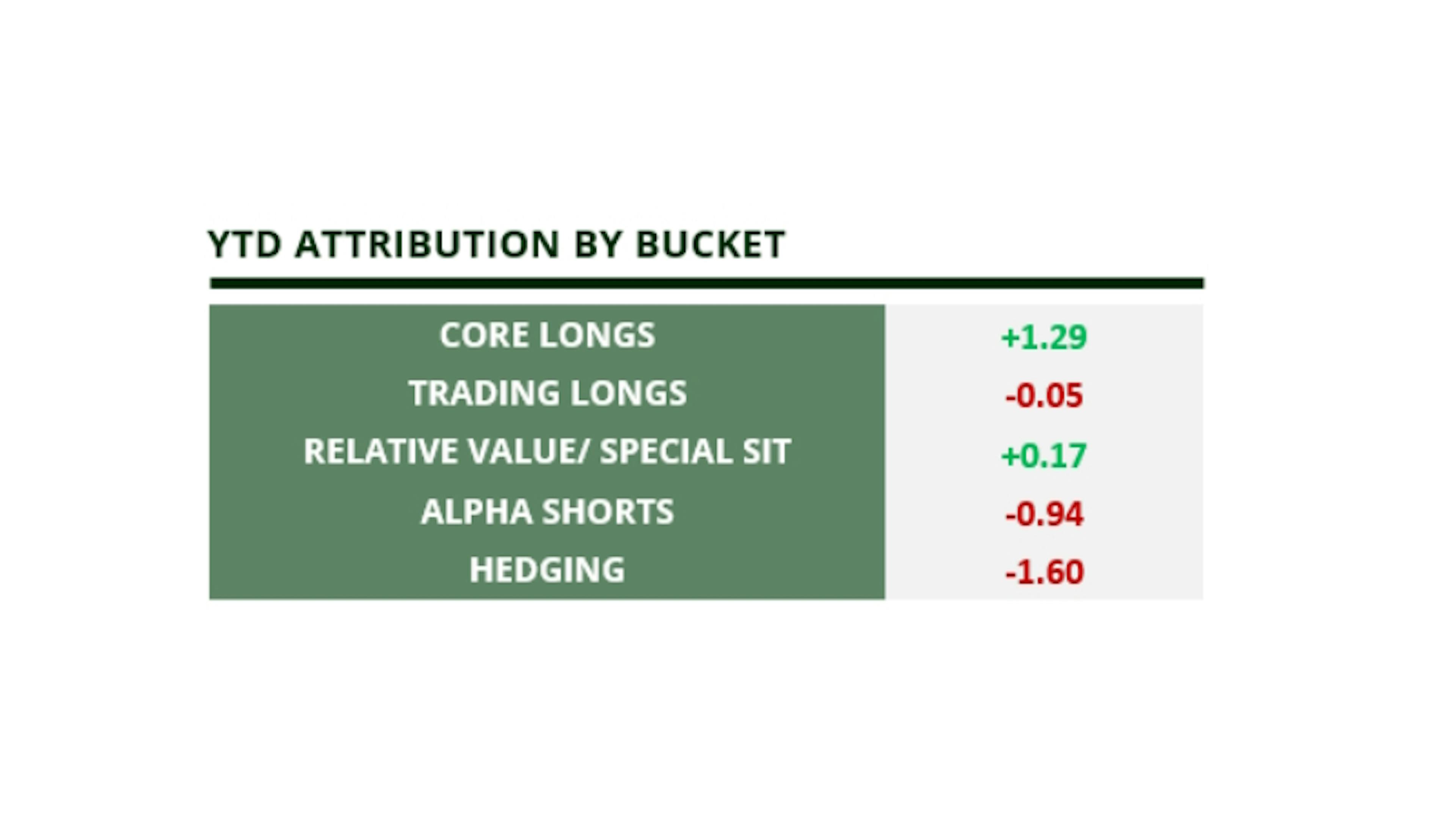

Overall, we had a good third quarter with the fund being up +1.42%, net of fees, while the Eurostoxx 50 was down -5.10%. As seen in the table below, while our Core Long book generated a positive performance, driven by our large convictions in Alcon, Prada and Microsoft; our Alpha Shorts suffered from the Beta and Momentum driven market rally.

This quarter, our hit rate jumped back into the 60ies. The three prior quarters had been frustrating for us, as our historically very high hit rate dropped significantly below what we had delivered over the past several years.

We ascribe this period of underperformance to the delayed effect of the Pandemic which dis-synchronized the normal economic cycle and had profound impacts on companies’ profits, cashflows and pricing power. The artificial supply shortage for many goods and services, which was triggered by supply chain disruptions, pent-up demand and changed order patterns, led to large backlogs and temporary pricing power for many commoditized businesses. These disruptions, and their impacts on companies’ financials, lasted longer than we had anticipated and the disconnect between leading indicators and hard economic data made forecasting earnings particularly challenging.

While shorts kept squeezing, as they benefitted from longer lasting dis-locations than we had anticipated, we struggled to fundamentally embrace the rally on many long positions, as we felt a lot of the factors that drove stocks higher were backward looking or mis-placed.

During the third quarter, we started to see a normalization of the trends described, with new orders declining, backlogs shrinking and pricing rolling over; while volumes stayed weak, due to a mixture of weak end-demand and de-stocking. While the recession that everyone expected last year never came and the market troughed in October 2022, many of the factors that led people to anticipate a recession back then, have not gone away.

Starting with the rates shock, after a temporary rally in bonds, long-term yields on both sides of the Atlantic are higher than they were in October. While people were concerned about the huge US fiscal deficit which needs to be financed, combined with the lack of demand from the largest US Treasury buyers, namely the Fed, Japan and China, the initial deficit was financed by spending down the Treasury General Account. Then, the Treasury General Account was refilled mainly through short dated treasury issuance that was hoovered up by money market funds that had seen huge inflows and moved out of the repo facility. While that delayed the problem, it did not solve it. While inflation has come down significantly in the last 12 months, the huge amount of longer dated supply that is coming to the market now in Q4 and next year is meeting a lack of demand that, together with a still strong US economy, is leading to higher yields. The higher yields, together with the fact that it is driven by higher term premia/higher real rates rather than inflation expectations, is leading to a very attractive alternative to equities (on top of cash) and depressed the equity risk premia to multi decade lows, making equities look relatively unattractive vs bonds and cash.

The intuitive multiple compression for the broader market now starts to come through. While rates had failed to have significant impact on corporates or consumers due to the longer maturities of their debt, higher for longer narrative does not only lead to multiple compression but also to a re-pricing of the medium-term interest expenses and hence earnings.

The consumer was the other surprise coming out of the 2022 inflation and rates shock. While the market was expecting a big squeeze and strain on consumption, the consumer held up much better than expected. Most consumers had used the last decade of low interest rates to refinance their debt into longer term, fixed rate debt, making them less sensitive to higher rates in the short term. On the other hand, they benefitted from high excess savings amassed during the pandemic that helped them keep up consumption. Lastly, the high backlogs in everything from housing to capital goods, together with a huge rebound in demand for services, led to a very tight labour market, wage growth and a feeling of job security. 12-month down the line, most of these excess savings has been spent and student loan repayment is resuming. While unemployment is still at record lows and the labour market is still very strong, this is a lagging indicator. We have started seeing consumer weakness in the form of volume weakness in consumer staples to a normalizing of luxury demand, while service demand has started showing signs of weakness as well. Therefore, consumption is still in a decent shape, but we would not expect incremental strength from that side.

Lastly, as discussed above, companies have significantly benefitted from the supply shortages and the inflationary environment since the pandemic. While forward-looking indicators like PMIs predicted a poor outlook for orders, revenues, and profits last year, the high backlogs and the significant price increases led to rising revenues and margins.

As expected, all good things must come to an end at some point. If any sector could give us a glimpse of the real demand environment and serve as a leading indicator, it was the chemicals sector. Due to the lack of a backlog and no supply chain issues, volumes in the sector have been miserable for almost a year now, due to a mix of weak end demand, de-stocking and pricing normalizing, leading to a flurry of profit warnings in the space. Several other cyclical sectors are starting to see similar patterns, as supply starts to come back, just at a time when demand hits a double whammy of weak end demand and destocking, together with pricing rolling over. It will lead to weaker sales, margins and profitability that will usually be followed by lay-offs and hence, risking unemployment and weaker consumption.

Finally, the geopolitical situation has unfortunately not improved. While a European energy crisis resulting from the Russia/Ukraine war was avoided, mainly due to the unseasonably warm weather which allowed Europe to fill their gas storages (at peak prices), Europe has not structurally solved their Energy problem and the resulting competitiveness of its manufacturing industry. Furthermore, the very unfortunate developments in the Middle East have the potential to create another energy crisis if the war spreads to the wider region and a proper oil price shock could trigger a recession.

A China/Taiwan escalation is not an if, but a when event, who’s timing is hard to predict. That said, it would not be completely un-realistic for China to move onto Taiwan while the US is already fighting and financing two wars and is not ready to defend Taiwan yet, as their base case is that an invasion would not happen before 2027.

Overall, the environment remains very volatile and while there are a lot of moving factors, we feel more comfortable as supply chains and companies’ financials have started to normalize from the aftermath of the pandemic. While we are aware of the macro environment, we keep our focus on company specific investment cases, and we are excited about the opportunities we see.

Wishing you a great Fall!

The European Long/Short Equity Team

Carmignac Portfolio Long-Short European Equities

A high-conviction long/short approach to European equitiesDiscover the fund pageCarmignac Portfolio Long-Short European Equities F EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 3/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- We do not charge an entry fee.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,15% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance if the performance is positive and the net asset value exceeds the high-water mark. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 1,05% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Portfolio Long-Short European Equities | 10.0 | 16.7 | 5.1 | 0.3 | 7.4 | 13.6 | -5.7 | 0.7 | 18.0 | 3.1 |

| Carmignac Portfolio Long-Short European Equities | + 5.5 % | + 7.2 % | + 5.5 % |

Source: Carmignac at Feb 28, 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: -

Related articles

Carmignac Merger Arbitrage: Letter from the Portfolio Managers

![[Main Media] [Funds Focus] Bridge](https://carmignac.imgix.net/uploads/article/0001/02/26ad7f7eb70cc9f1137127c5b230d8042189f9e1.jpeg?auto=format%2Ccompress&fit=fill&w=3840)

Carmignac Absolute Return Europe: Letter from the Fund Managers

Carmignac Portfolio Long Short European Equities: Letter from the Fund Manager

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In France, Luxembourg, Sweden: The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital. The Funds’ prospectus, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.