Why cash isn’t king

Carmignac’s Note

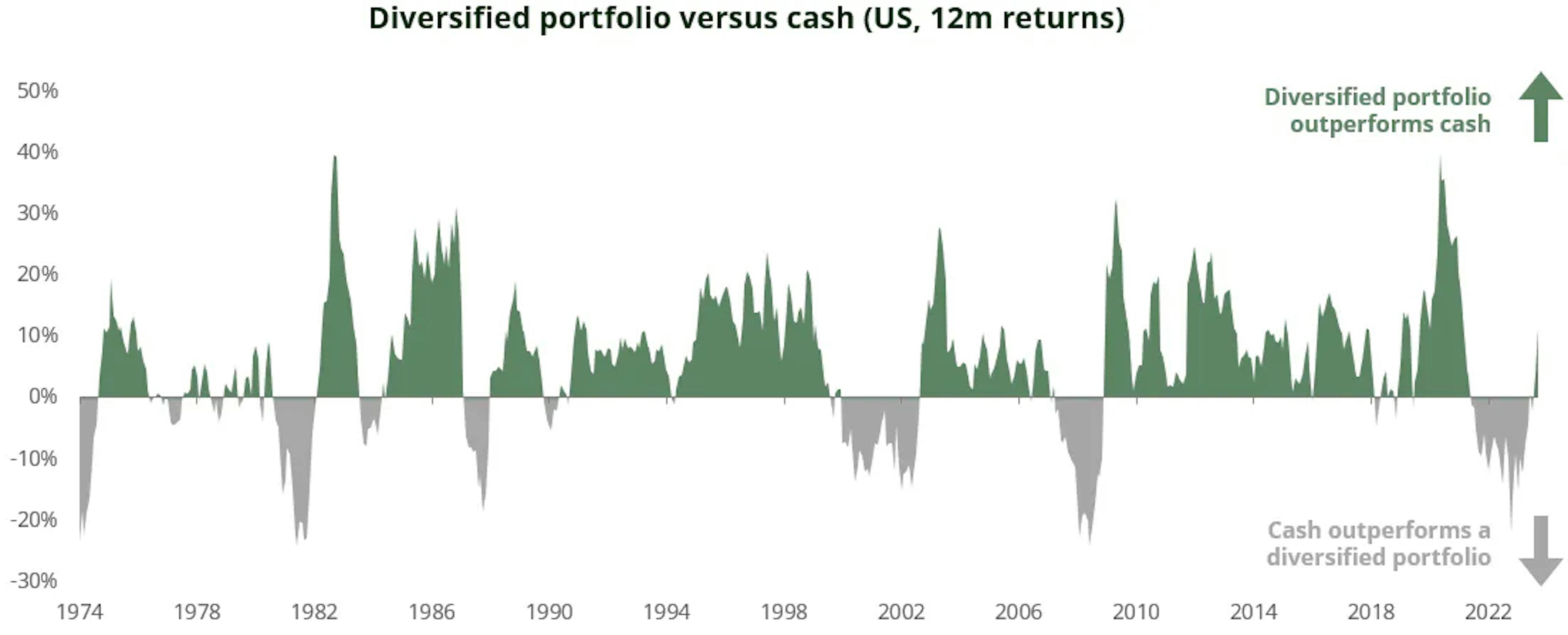

“While temporarily worthwhile, holding cash tends to be less rewarding than a diversified portfolio.”

Cash and cash equivalents have been performing well over the past two years. Better than a diversified portfolio allocated to both equities and bonds (sections in grey correspond to cash faring better than a diversified portfolio) in an environment where there were few places to hide as the worst bear market in fixed income markets continued to unfold1. This phenomenon has possibly contributed to the success of the recent tapping of domestic savings by European governments2. While in hindsight holding cash has been temporarily more rewarding that holding bonds and equities, looking in the rear view mirror has seldom been the best guide for future returns.

Seeking opportunities or seeking shelter?

A cash portfolio does provide a most welcome safe haven, notably at times of stagflationnary3 concerns. Yet timing is a difficult exercise. History suggests that investors are better off being invested in a diversified portfolio allocating to both equities and bonds, even when cash and cash equivalents are displaying yields as high or higher than equity risk premiums, corporate bonds yields or longer dated bonds.

Locking in 4% in EUR terms (or 5% in USD) by holding cash like instruments can be tempting. Yet rational investors should seek to look beyond the conspicuous and indisputable carry4 offered by such short-term instruments. After all, if it is yield one is seeking, some more compelling opportunities can be found in different market segments and asset classes.

In fixed income assets one can seek to capture both the yield component and the price component. Especially as reinvestment risk5 is a reality in an environment where both the European Central Bank (ECB) and the Federal Reserve (FED) are likely done with their hiking cycle. As such, one can secure the benefits of both an attractive yield today and lower bond yields down the line (which all else being equal, has a positive impact on the prices of such instruments).

In equity markets, bracing for tougher times ahead means debating whether this will take the form of a slower growth environment or a stagflationnary environment, where inflation surprises more on the upside than growth surprises on the down side. Beyond the delicate art of timing, the best suited approach to such a conundrum is the so-called “barbell”, investing in both stocks and sectors6 which would benefit from more persistent inflation and/or more stimulus from China, as well as in defensive sectors or stocks7.

In any case cash does not appear to be the whole answer. Rather cash can play the helpful role in reducing short-term risk and allows for speedy reallocation of investments towards the most promising side of the barbell, when the environment becomes more readable.

2Italian BTP Valore, Belgium Bons Van Peteghem raising close to EUR 20 billion each in a matter of days.

3Stagflation is the simultaneous appearance in an economy of slow growth, high unemployment, and rising prices.

4Carry can be defined as the money an investor will make holding a bond after taking into account funding cost. Carry is a metric that tells investors how time will play in their favour and to what extent (or not!).

5Reinvestment risk refers to the possibility that an investor will be unable to reinvest cash flows received from an investment, such as coupon payments or interest, at a rate comparable to their current rate of return.

6Gold, energy, materials, Japan, China.

7Healthcare, quality stocks, leaders in their fields.

Related articles

Shining in times of crisis: Why gold has never been a more valuable part of our portfolios

![[Management Team] [Author] Thozet Kevin](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Thozet-Kevi.png?auto=format%2Ccompress&fit=fill&w=3840)