Carmignac Emergents: Letter from the Fund Managers

Carmignac Emergents was down –3.69% in the second quarter, compared with a –5.76% decline in its reference indicator. Year to date, the Fund has delivered a performance of –14.80%, versus –10.40% for its reference indicator. During the first half of 2022, emerging-market equities continued the slide that started in early 2021. This downturn stemmed from decisions made by the world’s main central banks – particularly the Fed and the ECB – to start normalizing monetary policy after years of quantitative easing. The war in Ukraine also led to a dual shock, with impacts on food and energy prices. The combination of these two factors is creating formidable headwinds, as the resulting inflation is forcing central banks to adopt a strict policy stance that’s highly detrimental to equity markets.

What exactly happened in emerging markets in Q2 2022?

The positive surprise in Q2 came from China. Its stock market rebounded sharply and outperformed all major emerging and developed-world markets, despite the severe lockdowns introduced in some large Chinese cities. Xi Jinping’s zero-Covid strategy led to a chaotic implementation of lockdowns in Shanghai, Beijing, and many other regions. The country’s GDP contracted significantly in April and May but bounced back in June after Beijing loosened its Covid restrictions. China undoubtedly handled the pandemic relatively well during the first strain and the Delta variant, but now the highly contagious Omicron variant appears to be making the zero-Covid strategy much less effective with a stronger impact on the economy. It’s unlikely Xi Jinping will make any material changes to the strategy before the National Congress in the fourth quarter which should see him elected to a third term. However, Beijing has had some success in controlling the pandemic – it was able to contain the spread of the virus and reboot China’s economy through an array of stimulus measures that encompass infrastructure building, financial assistance for consumers, support for the automotive industry, and various tax cuts. Chinese equity investors welcomed these developments, and our Fund was able to benefit considerably from the rally in stock prices given our high exposure to China (38% of the Fund’s assets1). As we mentioned in our previous quarterly report, Chinese equity valuations had become very attractive following the steep decline in 2021, which was triggered by Beijing’s regulatory crackdown on the new economy, and Russia’s invasion of Ukraine. We stressed that we’ve been shoring up our positions in companies with a market capitalisation equal to less than their cash on hand. That’s what we did with New Oriental, for example, an education company whose stock price has doubled since mid-May2.

We added a new Chinese company to our portfolio in Q2: Full Truck Alliance. This firm runs a digital marketplace that matches up truck drivers and shippers, allowing businesses to schedule optimal shipping routes and prevent trucks from making return trips empty. Because shipping supply and demand is highly fragmented in China, there’s a need for this kind of marketplace, and Full Truck has a dominant 65% market share3. Our analysis indicates that the company’s business model requires little capital expenditure, offers a high return on equity, and holds promising growth prospects. Its stock had become priced very attractively, given that its cash on hand is equal to over a third of its market cap.3 Known as China’s "Uber of Trucks", the company aims to transform China’s road transportation industry by pioneering a digital, standardized, and smart logistics infrastructure across the value chain. The nature of its services is environmentally friendly as the business helps significantly save transportation cost versus traditional business models. The Company makes a positive impact on the environment by eliminating empty miles and wasted fuel. According to the company’s estimates, in 2020 they helped reduce carbon emissions by 330,000 metric tons as a result of a smarter logistics infrastructure. On the Social front, by improving supply/demand efficiency among shippers and trucks, and reducing idle time and wasted mileage, the business helps drivers to improve their productivity and their ability to manage their driving uptime, routing and safety.

Adjustments and current positioning

We took advantage of the turbulence in equity markets to focus our portfolio more heavily on our strongest convictions. We had just 34 holdings as of 30 June (not including the two Russian companies still in our portfolio which we can’t sell and are marked in our books at close to zero) – a level of concentration that’s never been seen before in the Carmignac Emergents Fund. This reflects our intention to pursue a highly active investment approach based on strong convictions. We believe that stock-market downturns provide opportunities to benefit from market inefficiencies, which are particularly pronounced in emerging markets.

Outside China, we believe the most attractive equity valuations can be found in South Korea (16% of the Fund’s assets). As the country’s stocks are (correctly) viewed as being cyclical, they were recently sold off on a large scale by global asset managers, resulting in downwards pressure that local institutional investors haven’t been able to offset. In addition, many South Korean retail investors had to meet margin calls that forced them to liquidate their positions. The country’s stocks are now trading at levels consistent with a lasting slump in global demand. However, most of our South Korean investments are in companies operating in secular growth themes like semiconductors. Demand for these electronic components is being fuelled by the digital revolution and the voracious appetite it’s creating for RAM to run datacentres and cloud-computing servers. The electrification of vehicles is another driver of semiconductor demand, and self-driving cars will be too in the coming years. Cars sold worldwide in 2025 are expected to require twice as many semiconductors on average as those sold in 2021. Samsung Electronics (8.3% of the Fund’s assets) is a global leader in semiconductor fabrication – yet is trading at less than four times operating profit, even though it has $120 billion of cash on its balance sheet. LG Chem (3.6% of the Fund’s assets) is a global leader in batteries for electric vehicles and its preferred stock is priced at less than five times operating profit4.

Our investments in Latin America (14% of the Fund’s assets) lost value in Q2 on the back of the drop in commodities prices – which weighed on the Brazilian real and the Mexican peso – and the bleaker growth prospects for these two countries’ economies. Our investments in Brazil and Mexico are focused mainly on domestic demand and on growth themes like finance (Banorte, B3 Bolsa), healthcare (Hapvida), the digital economy (MercadoLibre), and energy (Taesa, Isa Cteep). We’re optimistic about how markets will react to Brazil’s presidential election in October, as it should bring a moderate alliance into power and reduce political risk in the country. India (8.9% of the Fund’s assets) appears vulnerable in light of the high oil prices and the country’s record trade deficit. We therefore introduced temporary hedges to protect against a depreciation of the rupee.

Socially responsible investment is central to our approach

Our Flagship emerging equity Fund launched in 1997, Carmignac Emergents combines our core positioning as an emerging-market specialist since 1989 and our responsible & sustainable investment credentials within the EM universe. In welding together those two areas of expertise, we aim to add value for our investors while having a positive impact on society and the environment.

Carmignac Emergents is classified as an Article 9 fund under the Sustainable Finance Disclosure Regulation (SFDR)5, and was awarded France’s SRI label in 2019 and Belgium’s Towards Sustainability label in 20206.

As from 1st January 2022, Carmignac Emergents is classified as a financial product as described in Article 9 of Sustainable Finance Disclosure Regulation (“SFDR”). As such, the Fund will invest mainly in shares of emerging companies that have a positive outcome on environment or society and derive the majority of their revenue from goods and services related to business activities which align positively with SDGs. This sustainable objective will be measured and monitored by the percentage of revenues aligned with UN Sustainable Development Goals (SDGs)7.

Our portfolio is currently structured around six major socially responsible investment (SRI) themes that are central to our processes.

As a reminder, our socially responsibility approach is based on three pillars:

- Invest selectively and with conviction, giving priority to sustainable growth themes in underpenetrated sectors and countries with sound macroeconomic fundamentals.

- Invest for positive impact, favouring companies that deliver solutions to environmental and social challenges in emerging markets and reducing our carbon imprint by at least 30% relative to the MSCI Emerging Markets Index.

- Invest sustainably by consistently incorporating environmental, social and governance (ESG) criteria into our analyses and investment decision

Thematic allocation as of 30/06/2022: Focus on Beneficiaries of Digital Revolution & Long-Term Demographic Trends

Current Positioning as of 30/06/2022

Carmignac Emergents

Grasping the most promising opportunities within the emerging universeDiscover the fund pageRendement

| Carmignac Emergents | 1.4 | 18.8 | -18.6 | 24.7 | 44.7 | -10.7 | -15.6 | 9.5 | 4.6 | -0.5 |

| Referentie-indicator | 14.5 | 20.6 | -10.3 | 20.6 | 8.5 | 4.9 | -14.9 | 6.1 | 14.7 | -1.3 |

| Carmignac Emergents | + 2.8 % | + 8.3 % | + 3.1 % |

| Referentie-indicator | + 2.4 % | + 8.3 % | + 3.6 % |

Bron: Carmignac op 31 mrt. 2025.

In het verleden behaalde resultaten zijn geen garantie voor de toekomst. De resultaten zijn netto na aftrek van kosten (inclusief mogelijke in rekening gebrachte instapkosten door de distributeur) .

Referentie-indicator: MSCI EM NR index

Carmignac Emergents A EUR Acc

- Aanbevolen minimale beleggingstermijn

- 5 jaar

- SFDR-fondscategorieën**

- Artikel 9

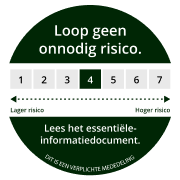

- Risicoschaal*

*Risicocategorie van het KID (essentiële-informatiedocument) indicator. Risicocategorie 1 betekent niet dat een belegging risicoloos is. Deze indicator kan in de loop van de tijd veranderen. **De Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is een Europese verordening die vermogensbeheerders verplicht hun fondsen te classificeren zoals onder meer: artikel 8 die milieu- en sociale kenmerken bevorderen, artikel 9 die investeringen duurzaam maken met meetbare doelstellingen, of artikel 6 die niet noodzakelijk een duurzaamheidsdoelstelling hebben. Voor meer informatie, bezoek: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=nl.

Voornaamste risico's van het Fonds

Recente analyses

Carmignac Portfolio Emergents: Brief van de Fondsbeheerders

Zuidoost-Azië: Een grootmacht in de maak