Dear Investors,

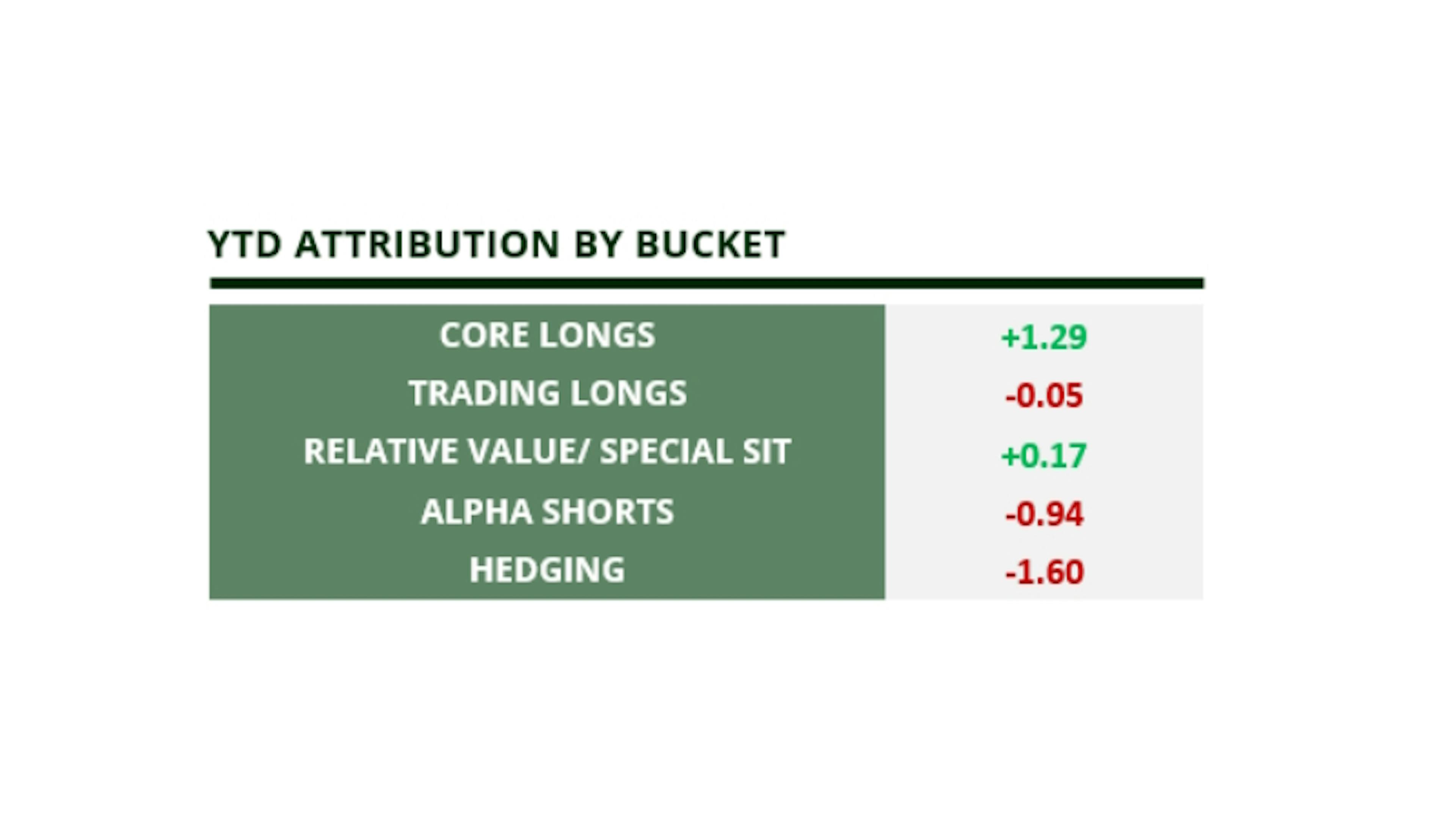

Overall, we had a good third quarter with the fund** being up +1.42%, net of fees, while the Eurostoxx 50 was down -5.10%. As seen in the table below, while our Core Long book generated a positive performance, driven by our large convictions in Alcon, Prada and Microsoft; our Alpha Shorts suffered from the Beta and Momentum driven market rally.

This quarter, our hit rate jumped back into the 60ies. The three prior quarters had been frustrating for us, as our historically very high hit rate dropped significantly below what we had delivered over the past several years.

We ascribe this period of underperformance to the delayed effect of the Pandemic which dis-synchronized the normal economic cycle and had profound impacts on companies’ profits, cashflows and pricing power. The artificial supply shortage for many goods and services, which was triggered by supply chain disruptions, pent-up demand and changed order patterns, led to large backlogs and temporary pricing power for many commoditized businesses. These disruptions, and their impacts on companies’ financials, lasted longer than we had anticipated and the disconnect between leading indicators and hard economic data made forecasting earnings particularly challenging.

While shorts kept squeezing, as they benefitted from longer lasting dis-locations than we had anticipated, we struggled to fundamentally embrace the rally on many long positions, as we felt a lot of the factors that drove stocks higher were backward looking or mis-placed.

During the third quarter, we started to see a normalization of the trends described, with new orders declining, backlogs shrinking and pricing rolling over; while volumes stayed weak, due to a mixture of weak end-demand and de-stocking. While the recession that everyone expected last year never came and the market troughed in October 2022, many of the factors that led people to anticipate a recession back then, have not gone away.

Starting with the rates shock, after a temporary rally in bonds, long-term yields on both sides of the Atlantic are higher than they were in October. While people were concerned about the huge US fiscal deficit which needs to be financed, combined with the lack of demand from the largest US Treasury buyers, namely the Fed, Japan and China, the initial deficit was financed by spending down the Treasury General Account. Then, the Treasury General Account was refilled mainly through short dated treasury issuance that was hoovered up by money market funds that had seen huge inflows and moved out of the repo facility. While that delayed the problem, it did not solve it. While inflation has come down significantly in the last 12 months, the huge amount of longer dated supply that is coming to the market now in Q4 and next year is meeting a lack of demand that, together with a still strong US economy, is leading to higher yields. The higher yields, together with the fact that it is driven by higher term premia/higher real rates rather than inflation expectations, is leading to a very attractive alternative to equities (on top of cash) and depressed the equity risk premia to multi decade lows, making equities look relatively unattractive vs bonds and cash.

The intuitive multiple compression for the broader market now starts to come through. While rates had failed to have significant impact on corporates or consumers due to the longer maturities of their debt, higher for longer narrative does not only lead to multiple compression but also to a re-pricing of the medium-term interest expenses and hence earnings.

The consumer was the other surprise coming out of the 2022 inflation and rates shock. While the market was expecting a big squeeze and strain on consumption, the consumer held up much better than expected. Most consumers had used the last decade of low interest rates to refinance their debt into longer term, fixed rate debt, making them less sensitive to higher rates in the short term. On the other hand, they benefitted from high excess savings amassed during the pandemic that helped them keep up consumption. Lastly, the high backlogs in everything from housing to capital goods, together with a huge rebound in demand for services, led to a very tight labour market, wage growth and a feeling of job security. 12-month down the line, most of these excess savings has been spent and student loan repayment is resuming. While unemployment is still at record lows and the labour market is still very strong, this is a lagging indicator. We have started seeing consumer weakness in the form of volume weakness in consumer staples to a normalizing of luxury demand, while service demand has started showing signs of weakness as well. Therefore, consumption is still in a decent shape, but we would not expect incremental strength from that side.

Lastly, as discussed above, companies have significantly benefitted from the supply shortages and the inflationary environment since the pandemic. While forward-looking indicators like PMIs predicted a poor outlook for orders, revenues, and profits last year, the high backlogs and the significant price increases led to rising revenues and margins.

As expected, all good things must come to an end at some point. If any sector could give us a glimpse of the real demand environment and serve as a leading indicator, it was the chemicals sector. Due to the lack of a backlog and no supply chain issues, volumes in the sector have been miserable for almost a year now, due to a mix of weak end demand, de-stocking and pricing normalizing, leading to a flurry of profit warnings in the space. Several other cyclical sectors are starting to see similar patterns, as supply starts to come back, just at a time when demand hits a double whammy of weak end demand and destocking, together with pricing rolling over. It will lead to weaker sales, margins and profitability that will usually be followed by lay-offs and hence, risking unemployment and weaker consumption.

Finally, the geopolitical situation has unfortunately not improved. While a European energy crisis resulting from the Russia/Ukraine war was avoided, mainly due to the unseasonably warm weather which allowed Europe to fill their gas storages (at peak prices), Europe has not structurally solved their Energy problem and the resulting competitiveness of its manufacturing industry. Furthermore, the very unfortunate developments in the Middle East have the potential to create another energy crisis if the war spreads to the wider region and a proper oil price shock could trigger a recession.

A China/Taiwan escalation is not an if, but a when event, who’s timing is hard to predict. That said, it would not be completely un-realistic for China to move onto Taiwan while the US is already fighting and financing two wars and is not ready to defend Taiwan yet, as their base case is that an invasion would not happen before 2027.

Overall, the environment remains very volatile and while there are a lot of moving factors, we feel more comfortable as supply chains and companies’ financials have started to normalize from the aftermath of the pandemic. While we are aware of the macro environment, we keep our focus on company specific investment cases, and we are excited about the opportunities we see.

Wishing you a great Fall!

The European Long/Short Equity Team

Carmignac Portfolio Long-Short European Equities

Carmignac Portfolio Long-Short European Equities F EUR Acc

- Duración mínima recomendada de la inversión

- 3 años

- Escala de riesgo*

- 3/7

- Clasificación SFDR**

- Artículo 8

*Escala de riesgo del KID (Documento de datos fundamentales). El riesgo 1 no implica una inversión sin riesgo. Este indicador podría evolucionar con el tiempo. **El Reglamento SFDR (Reglamento sobre la divulgación de información relativa a la sostenibilidad en el sector de los servicios financieros, por sus siglas en inglés) 2019/2088 es un reglamento europeo que requiere a los gestores de activos clasificar sus fondos, en particular entre los que responden al «artículo 8», que promueven las características medioambientales y sociales, al «artículo 9», que realizan inversiones sostenibles con objetivos medibles, o al «artículo 6», que no tienen necesariamente un objetivo de sostenibilidad. Para más información, visite: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=es.

Principales riesgos del Fondo

Gastos

- Costes de entrada

- No cobramos comisión de entrada.

- Costes de salida

- No cobramos una comisión de salida por este producto.

- Comisiones de gestión y otros costes administrativos o de funcionamiento

- 1.15% del valor de su inversión al año. Se trata de una estimación basada en los costes reales del último año.

- Comisiones de rendimiento

- 20.00% max. del exceso de rentabilidad cuando la rentabilidad sea positiva y el valor liquidativo supere la cota máxima o «High-Water Mark». El importe real variará en función de lo buenos que sean los resultados de su inversión. La estimación de los costes agregados anterior incluye la media de los últimos 5 años, o desde la creación del producto si se produjo hace menos de 5 años.

- Costes de operación

- 1.05% del valor de su inversión al año. Se trata de una estimación de los costes en que incurrimos al comprar y vender las inversiones subyacentes del producto. El importe real variará en función de la cantidad que compremos y vendamos.

Rentabilidades

| Carmignac Portfolio Long-Short European Equities | 10.0 | 16.7 | 5.1 | 0.3 | 7.4 | 13.6 | -5.7 | 0.7 | 18.0 | 7.4 |

| Carmignac Portfolio Long-Short European Equities | + 8.3 % | + 7.0 % | + 7.2 % |

Fuente: Carmignac a 28 de nov. de 2025.

Las rentabilidades históricas no garantizan rentabilidades futuras. La rentabilidad es neta de comisiones (excluyendo las eventuales comisiones de entrada aplicadas por el distribuidor)

Indicador de referencia: -

Comunicación publicitaria. Consulte el KID/folleto antes de tomar una decisión final de inversión. El presente documento está dirigido a clientes profesionales.

Este material no puede reproducirse, ni total ni parcialmente, sin el consentimiento previo de la sociedad gestora. Este material no constituye una oferta de suscripción ni un asesoramiento de inversión. Este material no constituye una recomendación contable, jurídica o tributaria y no debe ser tenido en cuenta a tales efectos. Este material se proporciona con carácter exclusivamente informativo y podría no resultar fiable a la hora de evaluar las ventajas derivadas de invertir en cualquier tipo de participaciones o valores mencionados en el presente documento o de cara a cualquier otra finalidad. La información contenida en este material podría no ser completa y estar sujeta a modificación sin preaviso alguno. Las informaciones se expresan a fecha de redacción del material y proceden de fuentes propias y externas consideradas fiables por Carmignac, no son necesariamente exhaustivas y su exactitud no está garantizada. En consecuencia, Carmignac, sus responsables, empleados o agentes no proporcionan garantía alguna de precisión o fiabilidad y no se responsabilizan en modo alguno de los errores u omisiones (incluida la responsabilidad para con cualquier persona debido a una negligencia). Las rentabilidades históricas no garantizan rentabilidades futuras.

La rentabilidad es neta de comisiones (excluyendo las eventuales comisiones de entrada aplicadas por el distribuidor). La rentabilidad podrá subir o bajar a resultas de las fluctuaciones en los tipos de cambio en el caso de las participaciones que carezcan de cobertura de divisas.

La mención a determinados valores o instrumentos financieros se realiza a efectos ilustrativos, para destacar determinados títulos presentes o que han figurado en las carteras de los Fondos de la gama Carmignac. Ésta no busca promover la inversión directa en dichos instrumentos ni constituye un asesoramiento de inversión. La Gestora no está sujeta a la prohibición de efectuar transacciones con estos instrumentos antes de la difusión de la información.

El acceso a los Fondos podrá estar restringido a determinadas personas o países. Este material no está dirigido a ninguna persona de ninguna jurisdicción en la que (debido al lugar de residencia o nacionalidad de la persona o a cualquier otra cuestión) el material o la disponibilidad de este material esté prohibido. Las personas objeto de estas prohibiciones no deben acceder a este material. La tributación depende de la situación de la persona. Los Fondos no están registrados para su distribución a inversores minoristas en Asia, Japón, Norteamérica ni están registrados en Sudamérica. Los Fondos Carmignac están registrados en Singapur como institución de inversión extranjera restringida (exclusivamente para clientes profesionales). Los Fondos no han sido registrados en virtud de la ley de valores estadounidense (US Securities Act) de 1933. Los Fondos podrán no ofertarse o venderse, directa o indirectamente, en beneficio o en nombre de una «Persona estadounidense», según la definición recogida por el Reglamento estadounidense S (Regulation S) y la ley FATCA. La decisión de invertir en el fondo debe tomarse teniendo en cuenta todas sus características u objetivos descritos en su folleto. Podrá consultar los folletos de los Fondos, los documentos KID, el VL y los informes anuales en la web www.carmignac.com/es-es o previa petición a la Gestora. Los riesgos, comisiones y gastos corrientes se detallan en el documento de datos fundamentales (KID). El KID deberá estar a disposición del suscriptor con anterioridad a la suscripción. El suscriptor debe leer el KID. Los inversores podrían perder parte o la totalidad de su capital, dado que el capital en los fondos no está garantizado. Los Fondos presentan un riesgo de pérdida de capital.

Para España : Los Fondos se encuentran registrados ante la Comisión Nacional del Mercado de Valores de España, con los números : Carmignac Sécurité 395, Carmignac Portfolio 392, Carmignac Patrimoine 386, Carmignac Absolute Return Europe 398, Carmignac Investissement 385, Carmignac Emergents 387, Carmignac Credit 2027 2098, Carmignac Credit 2029 2203, Carmignac Credit 2031 2297, Carmignac Court Terme 1111.

La Sociedad gestora puede cesar la promoción en su país en cualquier momento. Los inversores pueden acceder a un resumen de sus derechos en español en el siguiente enlace sección 5: www.carmignac.com/es-es/informacion-legal

Carmignac Portfolio hace referencia a los sub fondos de Carmignac Portfolio SICAV, una compañía de inversión bajo derecho luxemburgués, conforme a la directiva UCITS. Los Fondos son fondos comunes de derecho francés (FCP) conforme a la directiva UCITS o AIFM.

Para Carmignac Portfolio Long-Short European Equities: Carmignac Gestion Luxembourg SA, en su calidad de Sociedad Gestora de Carmignac Portfolio, ha delegado la gestión de la inversión de este Subfondo en White Creek Capital LLP (registrada en Inglaterra y Gales con el número OCC447169) a partir del 2 de mayo de 2024. White Creek Capital LLP está autorizada y regulada por la Financial Conduct Authority con el FRN : 998349.

Carmignac Private Evergreen hace referencia al compartimento Private Evergreen de la SICAV Carmignac S.A. SICAV – PART II UCI inscrita en el RCS luxemburgués con el número B285278.

![[Management Team] [Author] Heininger Malte](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Heiniger-Malte.png?auto=format%2Ccompress&fit=fill&w=3840)