Funds in Focus

Bond Fund of the Month: Carmignac P. Unconstrained Credit

Celebrates its third anniversary

![[Morningstar rating] 5 Stars](https://carmignac.imgix.net/uploads/article/0001/13/f2dc3cb2ff99a13f25b079f3bbf6d6ea5c571bf1.jpeg?auto=format%2Ccompress)

We are pleased to announce that Carmignac Portfolio Unconstrained Credit has been awarded 5 stars by Morningstar for its track record over 3 years.

-

Rich investment universeto capture the right investments across the entire credit spectrum

-

Flexible and opportunisticto implement an unconstrained and conviction-driven allocation

-

Looking for the optimal risk/returnto have the right positioning over the credit cycle

Adjusting our portfolio construction to different environments

Adjusting the risk taking of the fund depending on the quantity and quality of the opportunities we see in credit markets is central in our investment philosophy. We strive to have the courage to stay prudent when the market is expensive and euphory reigns, as well as the courage to be aggressive when panic reigns and opportunities abound.

Sticking with discipline to this playbook has been especially key to navigate the Covid19 crisis. We entered this turbulence prudently positioned as we felt credit markets were poor in opportunities at the beginning of 2020. When the crisis started to develop, we saw many companies whose credit spreads moved much more than their fundamental costs of risk, creating attractive investment opportunities that we seized.

Let's take a step back

Since launch, Carmignac Portfolio Unconstrained Credit posted a positive cumulative performance of +30.55% as of end-of-September, outperforming its reference indicator by +23.81% or an annualized outperformance of 6.70%.

A EUR Acc share class ISIN code: LU1623762843. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding applicable entrance fee acquired to the distributor). The Fund presents a risk of loss of capital.

-

2017

• Market environment: expensive markets, with stretched valuations supported by abundant liquidity

• Performance: slight outperformance, thanks to the carry of portfolio as well as relative value strategies -

2018

• Market environment: expensive markets during the first ten months of 2018. The last two months were characterized by a liquidity crisis creating appealing risk rewards

• Performance: our defensive positioning allowed us to remain in positive territory for 2018, while deploying capital towards attractive investments in the last two months

-

2019

• Market environment: market rich in opportunities early in the year, becoming gradually more expensive

• Performance: strong performance, thanks to the re-risking of the portfolio at the end of 2018 as well as a successful short position. -

2020

• Market environment: expensive markets, poor in opportunities until mid-March where we saw a dislocation linked to the Covid19 crisis

• Performance: the portfolio briefly suffered from the extraordinary volatility, but the re-risking we carried out just afterwards enabled us to return to positive performance

Market views & current positioning

Turning to what we are seeing today, even after the recent strong performance of credit markets, we find exciting opportunities. The excess spread of the portfolio, i.e. the difference between the spreads of bonds in the Fund and our estimation of these instruments’ costs of risk, is much larger than it has been in the years preceding the Covid-19 crisis.

We are back to an environment that combines rising default rates with large amounts of capital allocated to the asset class. In past credit cycles, as the fear of defaults was growing, capital was taken out of the asset class in order to be invested in safe haven. As we live a prolonged episode of financial repression, safe haven assets are not an alternative for many investors. Capital thus remains invested in credit despite the expectations of defaults, creating unprecedented demand for what most participants consider as safe while many other situations seem untouchable by the market. This dispersion, which was already a hallmark of the market environment in recent years, has dramatically increased with the recent events.

We think this long-term trend of rising dispersion is a blessing for bond pickers like us, creating unprecedented opportunities long and short.

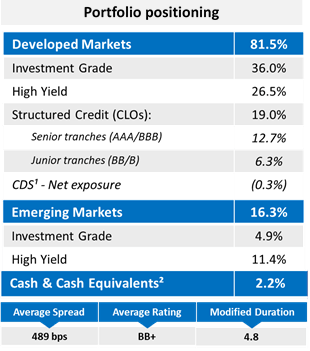

Hence, although we have slightly decreased the Fund’s exposure in the last few weeks to lock some profits, we are staying close to fully invested as attractive opportunities remain plentiful.

Carmignac Portfolio Credit A USD Acc Hdg

Recommended minimum investment horizon

Lower risk Higher risk

CREDIT: Credit risk is the risk that the issuer may default.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

LIQUIDITY: Temporary market distortions may have an impact on the pricing conditions under which the Fund might be caused to liquidate, initiate or modify its positions

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.