Our 2024 retrospective: The main market events and their ESG implications

Lloyd McAllister, Head of Sustainable Investment at Carmignac, looks back at the main market events of 2024 and assesses the role played by sustainable investment issues in these developments.

Artificial intelligence

10x

The massive deployment of artificial intelligence is at the heart of ESG debates. Despite its technological promise, it is consuming considerable amounts of energy and is accompanied by a rising chorus of concern about its societal consequences. A search via ChatGPT consumes ten times more energy than a Google search, putting a strain on already fragile electricity grids and will provide a temporary life-extension for coal and gas-generated electricity generation. In response, the major technology companies, while maintaining their climate pollution targets, are increasingly relying on significant decarbonisation in the latter half of the decade, in effect pushing back action, in the face of growing energy demands. This is coming at a time of increased difficulty in using easier methods of decarbonisation like offsets, which Alphabet has stopped using carbon credits2 and prompting a resurgence in nuclear, with Microsoft exploring reopening the Three Mile Island site3.

Interest rate cuts

Another dominant theme of the year, particularly in the second half, was interest rate cuts. Lower interest rates are generally welcomed by equity investors, as they reduce financing costs and thus promote growth. However, in the first half of 2024, total capital spending in the renewables sector has declined, mainly due to rising interest rates and ongoing reliability concerns as wind turbines continued to innovate their way to larger sizes. While investment in solar power grew by a modest 6%, wind power contracted by 11%4.

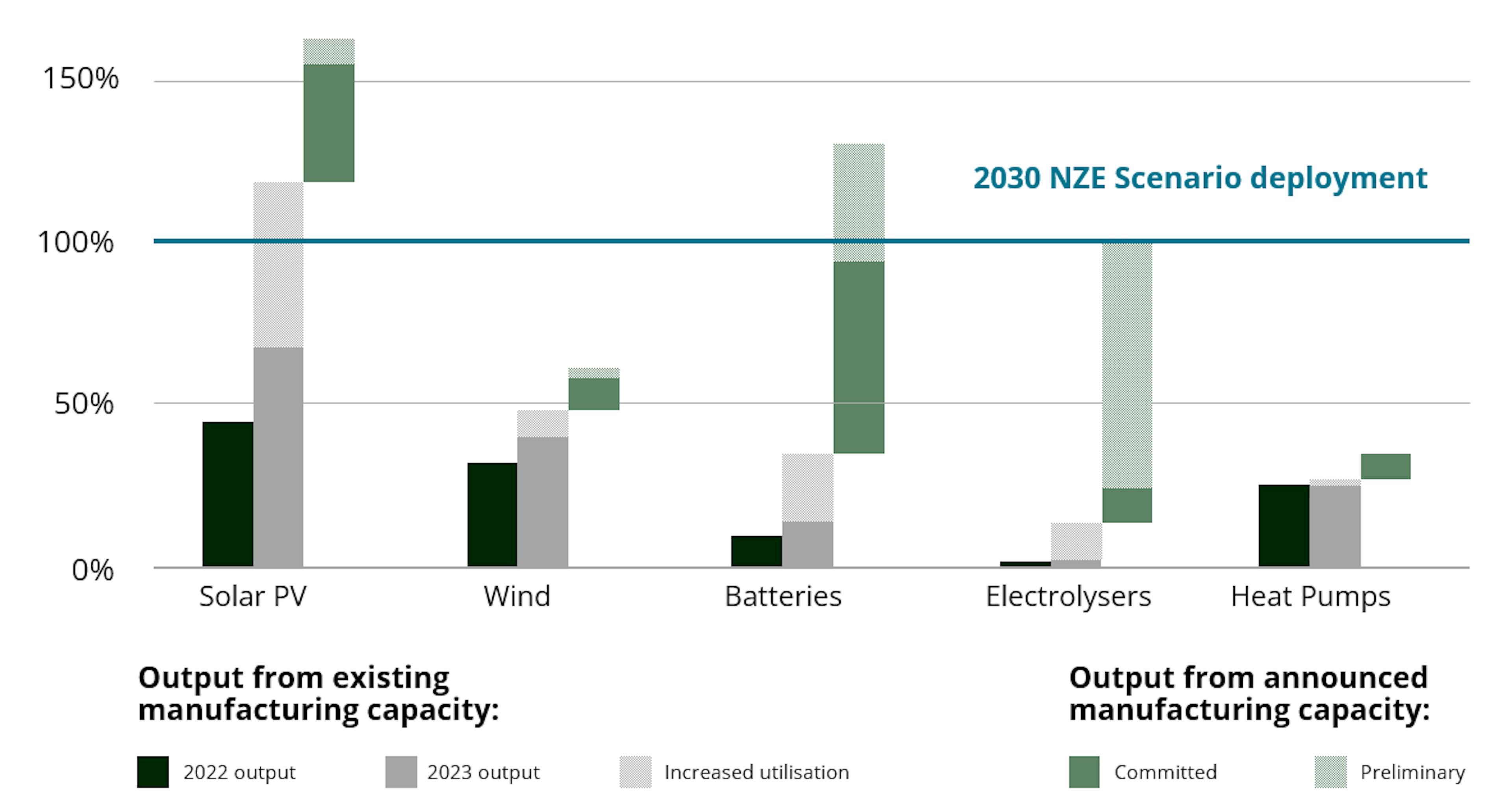

However, China has bucked this trend, substantially increasing its investment in renewable energy production capacity, to the point of meeting the 2030 targets for solar energy as early as 2024 as indicated in the chart below.

Net zero manufacturing capacity

China stagnation

Let's now focus on China's economic stagnation and its implications for ESG challenges. The Chinese government has begun a transition to a more centralised economy, focusing on geopolitical reorganisation rather than on stimulating economic growth. Massive investment in green technologies, coupled with exports at very competitive prices, is disrupting the industrial structures of Western economies. In response, they are trying to strengthen their internal competitiveness and are putting in place tariff barriers. The dumping of green technology and the use of human rights as a tool of trade protectionism are certainly issues to watch as President-elect Trump brings in further anti-China tariffs.

Obesity

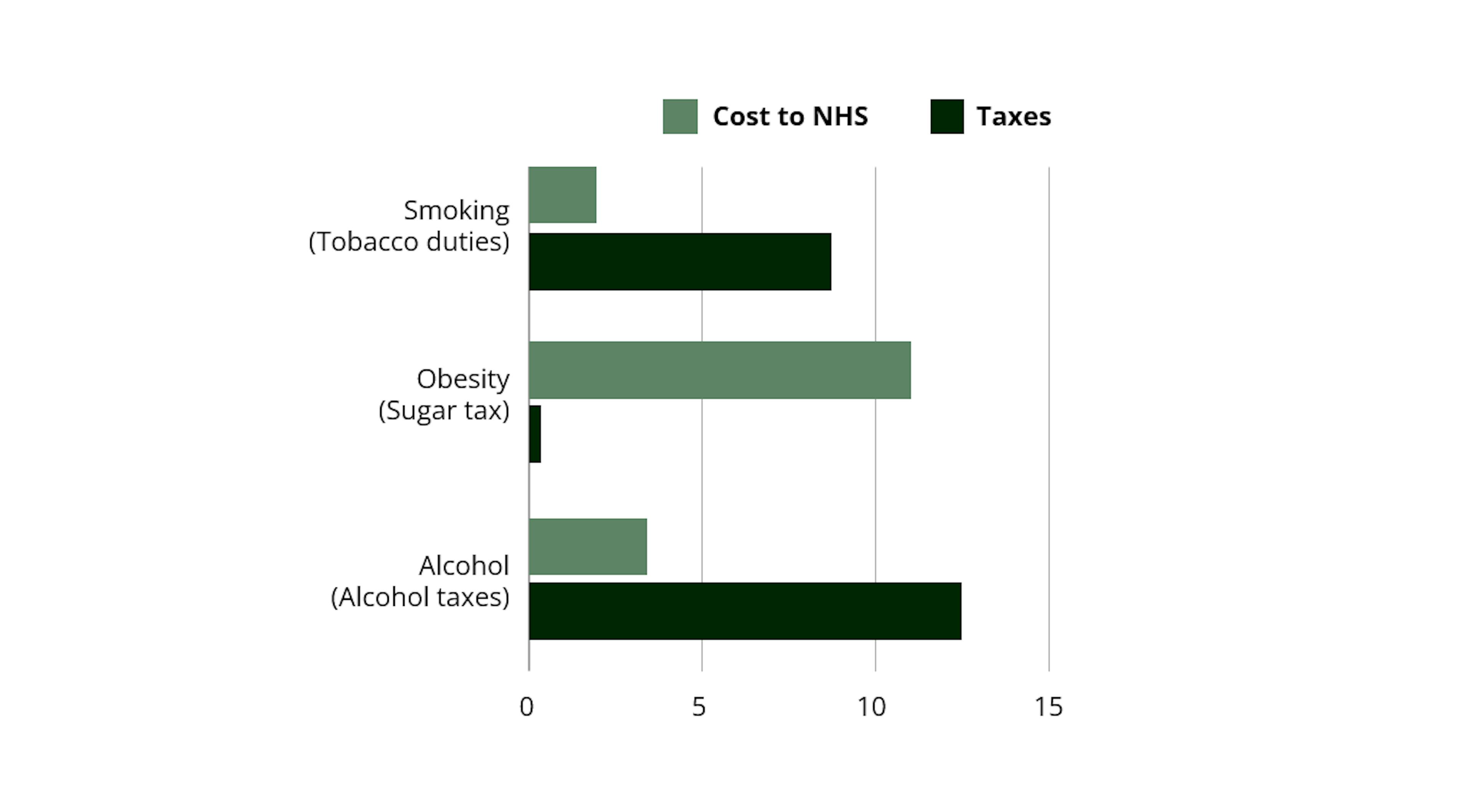

The use of GLP1 drugs against obesity has continued to show considerable economic opportunity this year, due to its promise to reduce negative externalities, a fundamental principle for sustainable investments. The economic cost of obesity is estimated at around 3% of global GDP, which is comparable to the economic costs associated with air pollution or climate change. Historic attempts at regulating obesity, for example through taxes on sugary drinks or food labelling, has had a limited impact. As a result, economies will have to turn to innovative technologies to reduce public health costs, which creates long-term uncertainties for unhealthy consumer goods companies who will need to continue to adapt offerings.

The costs to the healthcare system of tobacco, obesity and alcohol consumption

American elections

The election of Donald Trump in the United States creates an interesting moment for sustainable investment. While the overwhelming narrative is that Trump will be bad for sustainability outcomes, we are more optimistic with sustainability now firmly embedded into regulation and corporate strategies. His amendments to the Inflation Reduction Act will be guided by the world’s most successful green industrialist Elon Musk and some of his Health Secretaries ambitions of reducing chronic disease like obesity and diabetes through healthier diets and better farming practices are well aligned with sustainable objectives. It’s also worth remembering that his first term saw a trebling of investment into sustainable funds – although the US still only accounts for just 10% of global sustainable assets5 – and growth in renewable electricity production from 17% to 21%6. Of course, there will be obvious negative consequences such as the reduction of IRA subsidies for wind and electric vehicles, leaving of the Paris Accord, the gutting of the Environmental Protection Agency and the reduction of ESG disclosure requirements which investors have come to rely on to help assess future value, so of course there are trade-offs. One to watch.

The major themes of 2024 force us to confront three major challenges in sustainable investment. The first will be to rethink sustainable financing models in a context of reduced regulatory support, high public debt and low confidence in governments. Secondly, deglobalisation complicates the achievement of the multi-lateral initiatives such as United Nations Sustainable Development Goals, the Paris Agreement and the Montreal biodiversity targets. Finally, a robust conceptual framework for assessing the trade-offs between environmental, social and financial capital will be essential to align market outcomes more effectively with the realities of the world.

1Source: IEA Energy Outlook (2024).

2Source: Alphabet Environmental report (2024).

3Source: Source: Microsoft Sustainability report (2024).

4Source: BNEF Energy Investment Trends Report (2024).

5Source: JP Morgan (2024).

6Source: Bloomberg New Energy Finance (2024).

Marketing Communication. The decision to invest in the promoted fund should take into account all its characteristics or objectives as described in its prospectus. This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice.

UK: This document was prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg and is being distributed in the UK by Carmignac Gestion Luxembourg UK Branch (Registered in England and Wales with number FC031103, CSSF agreement of 10/06/2013).

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél : (+33) 01 42 86 53 35 Investment management company approved by the AMF Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel : (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF - Public limited company with share capital of € 23,000,000 - RC Luxembourg B 67 549.