Mining groups are key players in global energy transition, so working alongside them to help them make the shift to sustainable development is crucial, not only for the planet but also for investors.

Although mining companies are often criticized for their environmentally unsound practices, they play a key role in global energy transition. For this reason, helping these companies make the transition to sustainable development is a key issue for the future of the planet and for investors who want to have a positive impact on society and the environment.

The fight against climate change is a major societal and environmental challenge that the Paris agreement must, in part, help meet. Signed in December 2015, this agreement sets out a global framework for keeping global warming below 2°C between now and the end of the century, by endeavouring to limit the rise in temperature to 1.5°C, reducing polluting emissions and achieving carbon neutrality1 . To achieve these objectives, systems for producing more environmentally friendly energy and so-called "green" mobility have been created.

"Without the mining groups," warns Sandra Crowl, head of environmental, societal and governance (ESG) issues at Carmignac, “we won't be able to achieve our environmental objectives. If energy transition is to succeed, we need their metals.”

The technologies for producing today’s renewable energies and electric cars involve the use of several metals. Copper, nickel, cobalt, silver, aluminium, lithium and neodymium are all minerals extracted in large quantities for use in batteries, photovoltaic cells and wind turbines.

The extraction, production and transport practices of mining groups are often criticized by NGOs or policy makers, who see them as a threat to biodiversity and claim that they degrade soils and promote deforestation. However, an increasing number of companies are working on developing new technologies to help mining companies become more efficient, more environmentally friendly and safer for people and their employees.

A major challenge

"It is by engaging with mining companies on these issues that we can help them become more aware of these problems and to respond to environmental and societal challenges," explains Sandra Crowl. "It is the responsibility of investors to understand and support the industries that enable green technologies to thrive.”

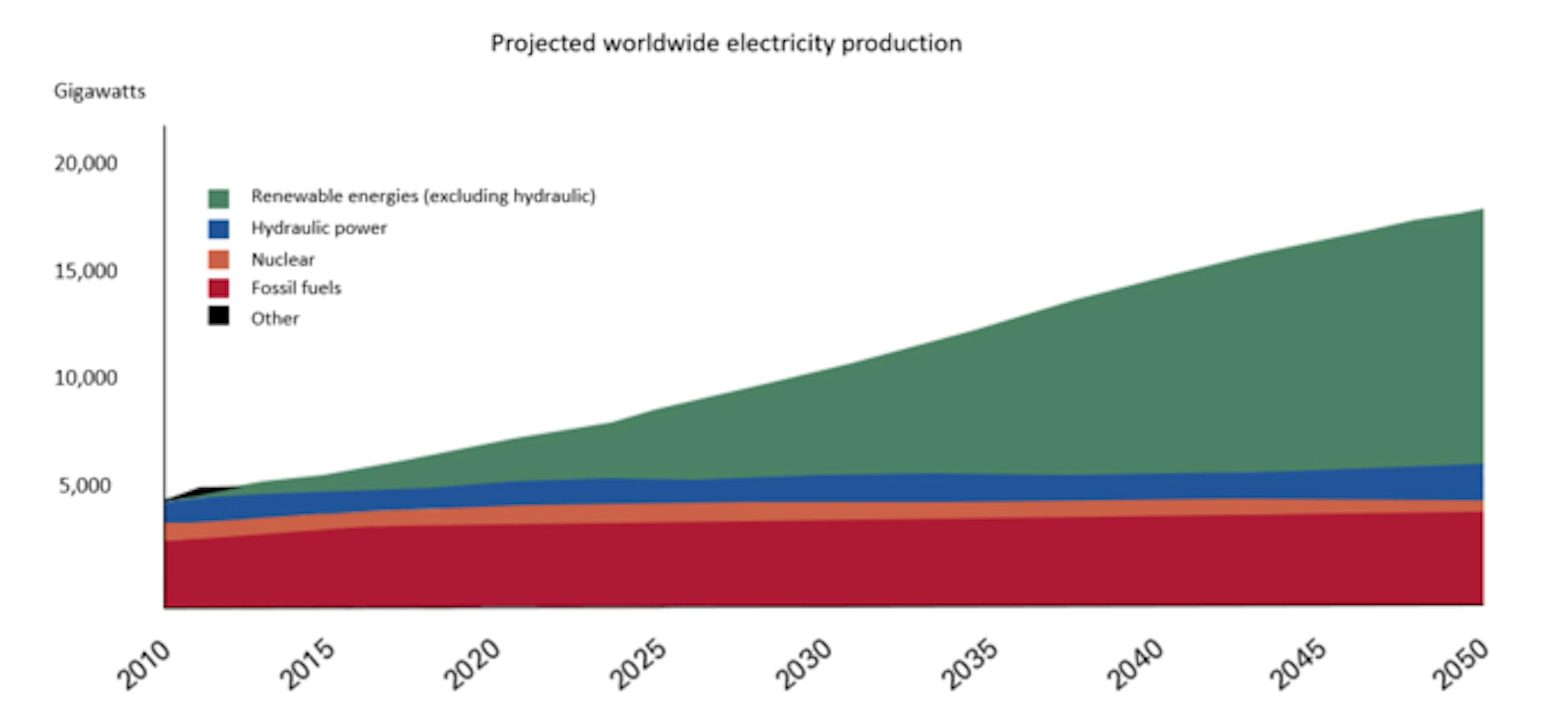

The challenge is indeed a significant one. The production of renewable energies, their storage, and green mobility will lead to a very sharp increase in the consumption of materials essential to energy transition, with demand expected to be two to six times higher than today by 2030, and even higher by 2050, according to Carmignac estimates.

For example, while traditional fossil fuel-based vehicles are cars with a combustion engine, electric vehicles (EV) are essentially batteries on wheels, and batteries are very metal intensive. So, the need for metals such as Lithium, Nickel and Cobalt are expected to increase in line with the growth of production of EVs. For instance, Nickel production is expected to rise tenfold over the next decade to meet the demand for batteries in EV and extend driving range.

"There is a lot of innovation going on in the mining sector, with companies developing recycling techniques and the reuse of rare minerals to extend product life and increase reserves,” notes Sandra Crowl. “We must nevertheless monitor these resources very closely.”

The rise in demand for materials is not without its problems. Today there are few, if any, real alternatives to metals such as copper or cobalt. Aluminium production consumes a lot of energy. In Indonesia, which is the largest nickel producer in the world, the biodiversity issue is highly sensitive due to the impacts of mines on the lands and the livelihoods of local communities, and the wasting of effluent water from mineral processing into the ocean not far from coral reefs.

In addition, the recyclability rate - the percentage of material that can be recycled or recovered at the end of its life - is very low, and in some cases zero (0% for silver and neodymium, 10% for lithium), based on data provided by The World Bank.

In this situation, investors play a vital role due to their ability to assess risks and potential in the long term. Through in-depth analysis of companies and a top-down view of the issues, they can provide support to the companies that need it and help them to improve their practices.

"We need to invest in companies that have a critical role to play in energy transition, but not just in those that seem the most obvious," says Sandra Crowl. "We believe it would be irresponsible to invest only in perfectly virtuous companies and to exclude those that are also key to facilitating energy transition, such as mining groups, because of higher levels of CO2 emissions or past controversies.”

Moreover, frameworks and best practice guides have been put in place to enable investors to assist companies in meeting the challenges raised by sustainable development. This is the case in the mining sector with, for example, the framework proposed by the Responsible Mining Foundation. It promotes best practices in six thematic areas: economic development, business conduct, life cycle management, community well-being, working conditions and environmental responsibility.

"As an investor, you can't just take a superficial view if you want to understand environmental and societal issues," says Sandra Crowl. "Taking a more holistic view of green technologies will allow us to better assess their positive and negative impacts on the environment and ensure that our green technologies are truly green.”