Family businesses in five charts

Do family businesses deliver better stock-market performance than other companies? If so, why? What ownership breakdown is most effective, and does business performance change over generations? Should we look to developed or emerging markets for the best-run family firms? These are all questions that you may have to answer if you’re thinking about investing in a family owned and/or managed company.

1) Do family businesses outperform in the stock market?

According to our Carmignac Family 500 database, if you invested €100 in a family business in January 2004, you would have €297 at the end of October 2022, compared with €251 if you had invested in a non-family business.

Reasons for this outperformance include: skin in the game1, a longer-term investment horizon and higher risk aversion. Family businesses are generally run with a long-term view based on earnings growth and profit-margin stability. As they invest their own money in their business, managers of family firms also tend to be more risk-averse. Founding families usually play a large role in business decisions, with a view to preserving family wealth and passing the company on to their children and grandchildren.

Family businesses are also characterised by:

- Higher returns – The return on equity (ROE) for family businesses was 15.1% at the end of October 2022. But the equivalent figures for non-family companies was lower: 13% (ROE). This shows that family businesses tend to be managed more efficiently.

- Lower leverage – Family firms have lower net debt-to-EBITDA ratios: -0.07, versus 0.9 for non-family companies (equal to about one year of debt service costs). This indicates that family firms generate relatively more cash.

2) Does stock market performance change with later generations?

When it comes to family wealth, there’s an old adage that says: "The first generation builds, the second generation expands, and the third generation squanders." Is that true for family businesses, too?

There’s evidence that stock-price appreciation tends to decline as younger generations take over the firm. Over the period from January 2004 to October 2022, the stocks of companies run by the first generation gained almost twice as much as those run by the fifth generation. Part of this reflects the heavy investment needed to adapt and keep growing a company as it ages.

3) What’s the most effective ownership breakdown?

Looking again at the period from January 2004 to October 2022, the stocks of businesses that are more than 50%-owned by the founding family post much higher gains than companies with lower family stakes. This is largely due to better alignment between the interests of shareholders and management.

Such majority-owned businesses are also less subject to the demands of minority shareholders whose interests may not be consistent with those of management and/or the company's long-term goals.

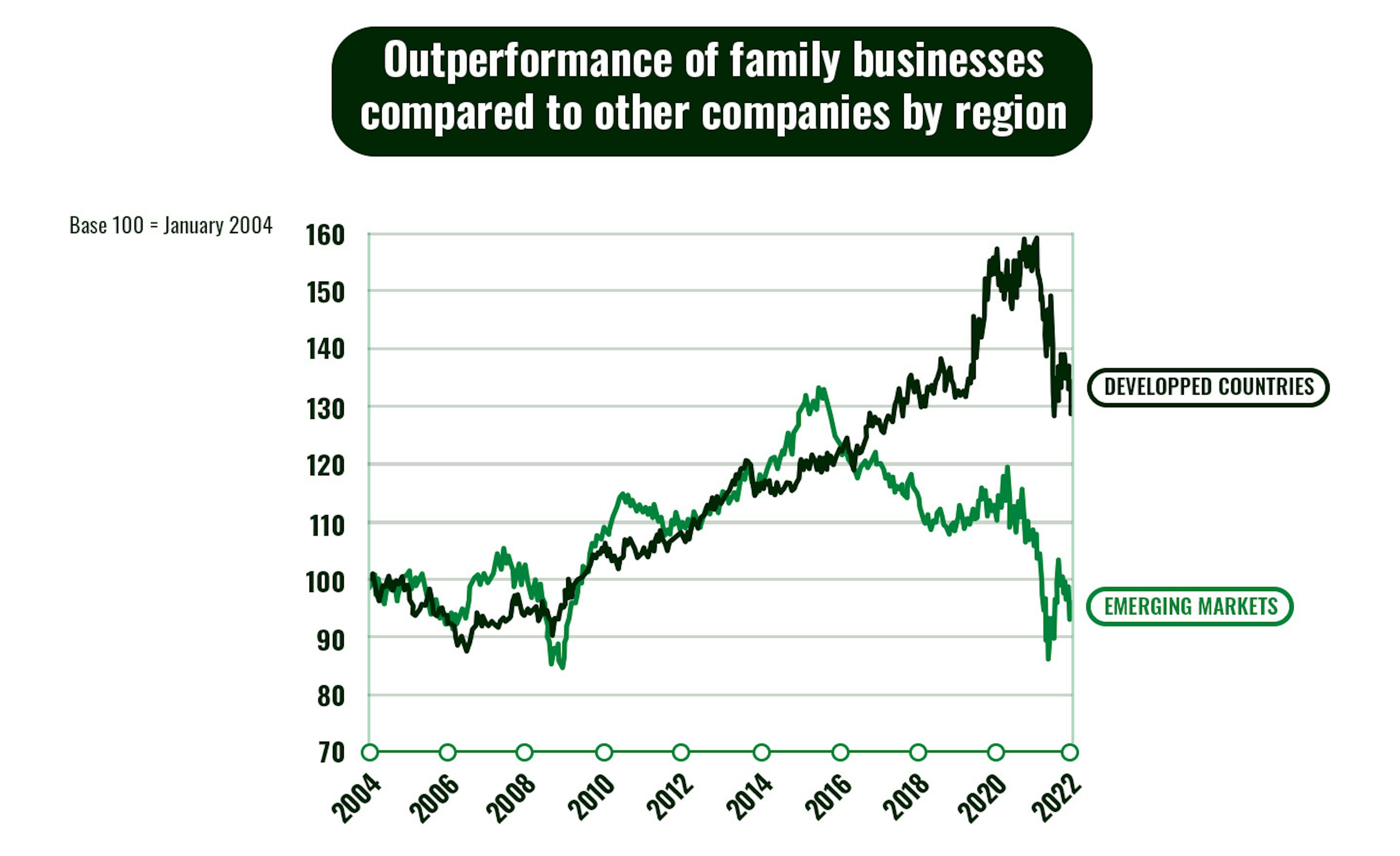

4) Where are the best-performing family businesses found?

Family businesses generally outperform non-family businesses by a greater extent in developed countries than in emerging ones. This can be attributed to better corporate governance – an issue that’s increasingly important to investors – in the developed world. In addition, stock prices in emerging markets tend to be more volatile and show wider dispersion in returns, owing mainly to the higher risk premiums.

5) Do large or small family businesses perform better?

According to our Carmignac Family 500 database, €100 invested in a mega-cap family business (with a market value of >$50 billion) in January 2004 would be worth €452 by the end of October 2022. The same amount invested in a large-cap family business (market value of $10 billion to $50 billion) would be worth some €270 today. For small- and mid-caps, the investment would have more than tripled: up by a factor of 3.4 for mid-caps (market value of $2 billion to $10 billion) and by a factor of 3.1 for small caps (market value of <$2 billion).

Very large companies are often more mature, meaning they generate less volatile returns, even in times of crisis. They also have deeper pockets and can achieve greater stability in profit margins and earnings. On the other hand, small companies are more vulnerable to market shocks and have less bargaining power for negotiating the interest rates on their loans, resulting in a relatively higher cost of capital.

Small companies tend to be more agile with higher growth potential, but large companies offer greater stability in business development. Large companies are also more likely to be sector leaders.

While these are all probing facts, caution is needed before jumping to conclusions. There are many large family businesses out there that tick all the boxes – majority-owned by their founders, run by the first generation, and listed in a developed country – but not all of them necessarily make for a successful investment.

The reality is much more complex, and many other factors need to be taken into account: a company’s governance, sector, and specific circumstances, for example. Before selecting a family business to invest in, you should perform further analyses and meet with its management team; it’s also worth considering where the economy is in the business and market cycle.

That’s why it may be preferable to call on professional asset managers with the expertise to carefully study and assess family businesses – a market segment that can make for a promising addition to your portfolio.

The term "skin in the game" refers to a situation in which the managers of a company use their own money to invest in their business.

Related articles

Carmignac Portfolio Human Xperience: Letter from the Fund Manager

Carmignac launches Tech Solutions Fund to seize next wave of tech innovation

Carmignac Portfolio Human Xperience celebrates its three-year anniversary

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com/en, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.com/en-gb, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.com/en-ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.

For Carmignac Portfolio Long-Short European Equities: Carmignac Gestion Luxembourg SA in its capacity as the Management Company for Carmignac Portfolio, has delegated the investment management of this Sub-Fund to White Creek Capital LLP (Registered in England and Wales with number OCC447169) from 2nd May 2024. White Creek Capital LLP is authorised and regulated by the Financial Conduct Authority with FRN : 998349.

Carmignac Private Evergreen refers to the Private Evergreen sub-fund of the SICAV Carmignac S.A. SICAV – PART II UCI, registered with the Luxembourg RCS under number B285278.