Flash Note

Carmignac Portfolio Grandchildren celebrates its four-year anniversary

- Published

-

Length

4 minute(s) read

Carmignac Portfolio Grandchildren adopts a long-term vision by investing in high-quality companies in developed markets through a sustainable approach. This equity Fund is celebrating its fourth anniversary. This milestone provides a chance to reflect upon the Fund's key defining characteristics.

A Fund that invests in “Compounders” for the future

Carmignac Portfolio Grandchildren aims to achieve long-term outcomes by identifying high-quality companies with a true long-term growth potential. These companies reinvest their earnings to grow their businesses for the future which enables them to remain profitable over time. Embracing this long-term vision gives these companies the ability to adapt to different market environments. We call these high-quality companies, Compounders.

-

Mastercard: finding a quality company is priceless

Mastercard is an American company in the technology sector best known, for its payment processes worldwide.

In our view, Mastercard is a quality company as the company offers a healthy profitability underpinned by a solid franchise that generates recurring revenues, pricing power and low capital intensity. These characteristics allow Mastercard to reinvest and fuel innovation to create additional growth engines.

Beyond its well-established business, Mastercard is taking profit from the potential of digital asset innovation in the blockchain and tokenization supported by its recognized expertise in terms of payment solution. This position enables the company to benefit from a predictable business with a solid competitive advantage.

By investing in the company, the Fund aims not only to build financial wealth, but also to leave a more sustainable world for future generations.

Building a legacy for future generations

By focusing on Compounders, Carmignac Portfolio Grandchildren meets expectations of investors looking for a long-term savings solution. Indeed, the Fund aims to build a legacy not only for the investors themselves, but also one that can be passed on from one generation to the next.

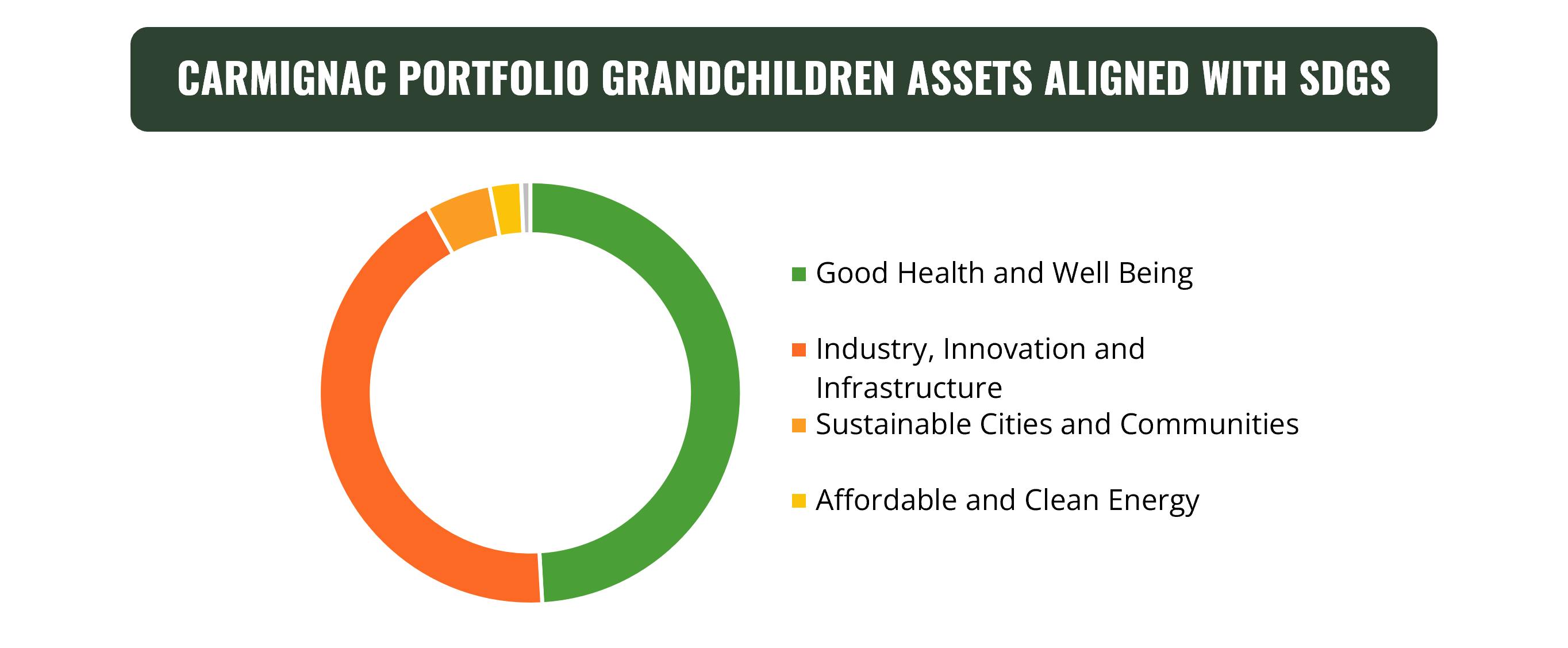

With this objective of transmission through the generations, we are convinced that, as investors, it is our responsibility to create value for our clients through a sustainable approach, and to have a positive footprint on tomorrow’s world. We strive to identify firms generating positive change based on the Sustainable Development Goals (SDGs) defined by the United Nations.

-

Microsoft: innovating for a more sustainable world

Microsoft is an American company in the technology sector best known for its software products.

By investing in Microsoft, the Fund contributes to the SDG “Industry, Innovation and Infrastructure”. Microsoft is not only profitable thanks to its wide and high-performance range of products which enables the company to be one of the major players in the technology industry, but it also reinvests its profits to improve artificial intelligence and gaming industries, among others.

In this way, the company contributes positively to society by building resilient infrastructure, promoting inclusive and sustainable industrialization, and fostering innovation. We also note that on a Governance axis, the company also presents a best-in-class management team, in our view.

A long-term investment solution supported by a proven track-record

Fund’s launch: 31/05/2019. Performance as of 31/05/2023. *MSCI World (USD, Reinvested net dividends). **Morningstar category average.

Carmignac Portfolio Grandchildren has posted solid annualised net performance since launch, outperforming its reference indicator and its category. This puts the Fund in the top quartile since the start of 2023, over 1 year, 3 years and since launch. This positive performance is underpinned by the sound business models of the companies in which the Fund invests, which generate positive underlying results over the long term. A further example of the benefits of compounding.

By focusing on companies that reinvest their profits, Carmignac Portfolio Grandchildren offers long-term opportunities through businesses that we think could remain profitable by continuously adapting to their environment.

Carmignac Portfolio Grandchildren A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Carmignac Portfolio Grandchildren A EUR Acc

| 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|

| Carmignac Portfolio Grandchildren A EUR Acc | +15.47 % | +20.28 % | +28.38 % | -24.16 % | +23.04 % | +23.87 % |

| Reference Indicator | +15.49 % | +6.33 % | +31.07 % | -12.78 % | +19.60 % | +27.44 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio Grandchildren A EUR Acc | +6.01 % | +12.52 % | - |

| Reference Indicator | +11.12 % | +13.37 % | - |

Scroll right to see full table

Source: Carmignac at 29/11/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,70% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,26% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |